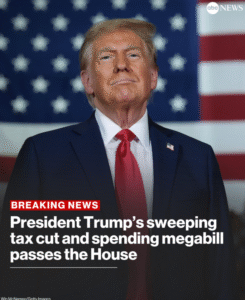

The U.S. House of Representatives has given final approval to former President Donald Trump’s sweeping new tax and spending bill, officially sending it to him for signature. The legislation, referred to by Trump and his allies as the “One Big Beautiful Bill,” passed by a narrow margin of 218–214, largely along party lines. It marks one of the most significant legislative victories for Trump since his return to office and is set to reshape federal tax policy, social spending, and government priorities for years to come.

At the heart of the bill are major tax cuts, including the permanent extension of Trump’s 2017 tax reforms. These include reduced rates for individuals and businesses, a boost to the child tax credit, and new deductions for service workers, such as tips and overtime pay. Seniors earning less than \$75,000 annually will also be eligible for a new \$6,000 tax deduction.

The legislation introduces “Trump Accounts,” tax-deferred savings accounts available for every newborn American citizen, aimed at promoting lifelong saving and investment. A controversial provision lifts the cap on state and local tax (SALT) deductions to \$40,000 for five years, benefiting many in higher-tax states.

On the spending side, the bill sets aside \$350 billion for enhanced border security, including funding for new detention centers and immigration enforcement. However, it also makes deep cuts to Medicaid, food assistance programs, and certain clean energy initiatives introduced under previous administrations. These cuts come with new work requirements for benefits, which critics argue will disproportionately affect low-income families and vulnerable populations.

The bill also includes funding for rural hospitals, veterans’ services, space exploration, and defense, as well as new national park fees to offset environmental costs. Another key provision is a \$5 trillion increase in the national debt ceiling, aimed at preventing a government default and ensuring continued federal borrowing capacity.

Supporters of the bill claim it will stimulate the economy, reward work, and encourage family stability. Opponents argue that the tax benefits are skewed toward wealthy individuals and corporations while cutting critical safety nets for the poor and disabled. The Congressional Budget Office estimates the bill will add nearly \$4 trillion to the national debt over the next decade.

Despite the partisan battle, Trump is expected to sign the bill into law on July 4, a symbolic date chosen to highlight themes of freedom and national renewal. The signing is likely to be followed by a national tour promoting the legislation as a cornerstone of Trump’s renewed vision for America.

The political fallout is already being felt, with Democrats fiercely opposing the bill and two Republicans breaking ranks to vote against it. As the country braces for the impacts of this historic legislation, both supporters and critics agree—it will shape America’s fiscal and social landscape for years to come.